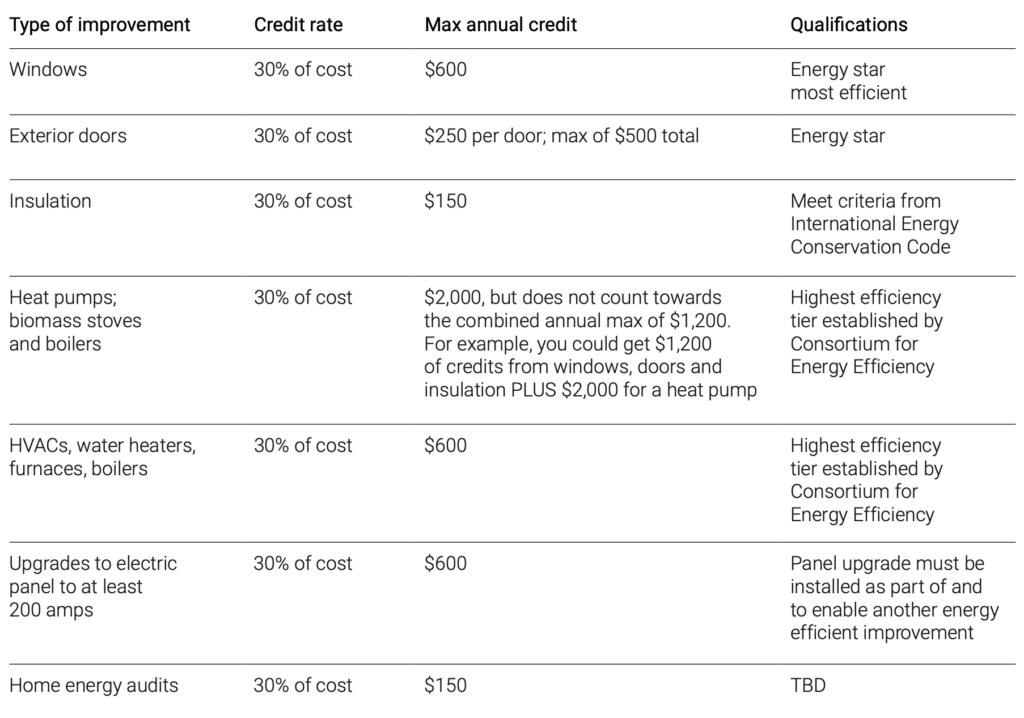

Home Improvement Deduction 2024 Amount – The energy efficient home improvement credit can help homeowners cover up to 30% of costs related to qualifying improvements made from 2023 to 2032 . For these types of upgrades, the IRS offers a tax credit called the Energy Efficient Home Improvement Credit. A tax credit differs from a tax deduction in that it reduces the amount of taxes you .

Home Improvement Deduction 2024 Amount

Source : mmccu.comEnergy Efficient Home Improvement Credit 2024 NerdWallet

Source : www.nerdwallet.comAre Home Improvements Tax Deductible? | Sea Pointe

Source : www.seapointe.comEnergy Efficiency Home Improvement Credit 2024: How to Qualify

Source : www.ecofoil.comHome Improvement Projects That Could Be Tax deductible (2024

Source : todayshomeowner.comAre Home Improvements Tax Deductible? (2024 Guide)

Source : www.marketwatch.comGreen Home Improvements? Get Tax Credits with Inflation Reduction

Source : smithpatrickcpa.comSolar Tax Credit By State 2024 – Forbes Home

Source : www.forbes.comHome Improvement & Remodeling Coupons in Buffalo NY

Source : www.ivyleaconstruction.comHeat Pump Tax Credit 2024 – Forbes Home

Source : www.forbes.comHome Improvement Deduction 2024 Amount What to Know about a Home Renovation Loan in 2024 Marshfield : Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the . There are other IRS rules you must meet to qualify for the deduction than home improvements for tax years 2018 through 2025. There are also instances when you cannot deduct the full amount .

]]>